The Benefits of Choosing a Local Mortgage Broker

Why you should go to your local mortgage advisor for mortgage advice

Don't be distracted by big banks and lenders touting cheap prices - sometimes, in order to get the best mortgage deal, you have to look a bit closer to home.

A good mortgage broker is like gold dust - hard to find but priceless once you do. Mortgage brokers are key in supporting you through the tasks of obtaining a mortgage; from the application process all the way through to the valuation and completion, a reliable mortgage broker will be there to help you through.

It might seem more accessible and economical to go to the big high street names for mortgage advice, but don't be so hasty. There are many other options when it comes to finding the best mortgage deals, and there are advantages to seeking the expertise of an independent mortgage like The Lending Channel.

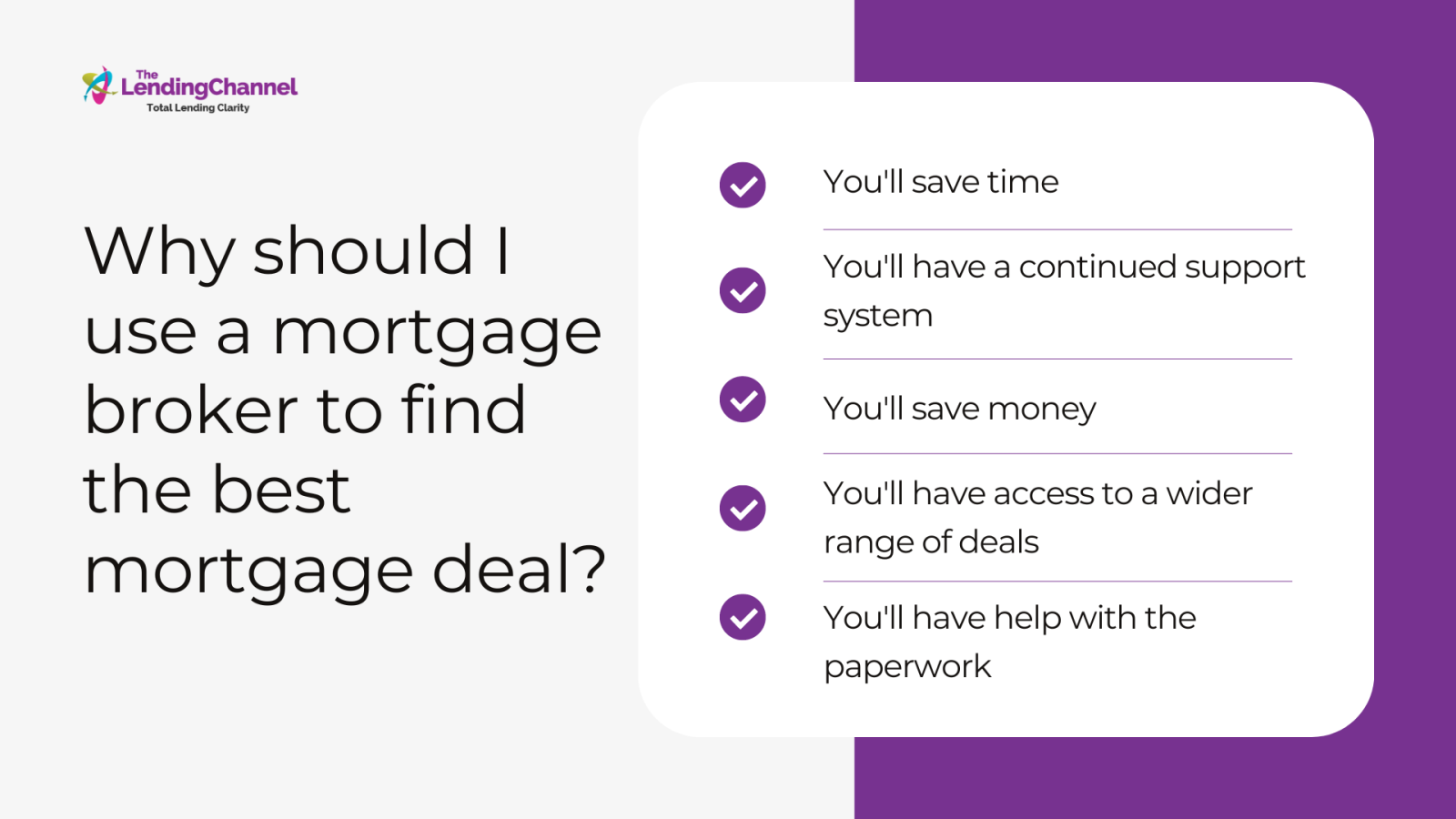

Why should i use a mortgage broker to find the best mortgage deal?

- You'll save time

Finding the best mortgage deal for you is a time-consuming process. With so many different mortgage lenders, mortgage products, interest rates and types, you'll have to wade through all the options available.

Many lenders don't readily advertise their best rates, so you'll have to reach out to each of them in order to start a conversation. A local mortgage expert like The Lending Channel can do all of this on your behalf. After many years of experience, we have a number of existing relationships to call on to negotiate the best deals.

- You'll have a continued support system

Whether you're a first-time buyer or a seasoned professional, navigating the mortgage market can be intimidating at the best of times. From initial consultation up to mortgage approval, we'll be right by your side.

Seeking mortgage advice from qualified mortgage brokers can help minimise stress, and you'll know that you're in safe hands when it comes to the mortgage process.

- You'll save money

The right mortgage advisor will help you discern and evaluate your financial needs. This will lead to you obtaining a mortgage that is better suited to you and your financial situation, meaning that you'll save money in the long run.

- You'll have access to a wider range of deals

Some deals are only accessible to mortgage brokers, so it's always a good idea to have your broker use their network to uncover the best deals.

- You'll have help with the paperwork

Especially if you are a first-time buyer, the paperwork that goes into purchasing a property can be very daunting. We'll be here to help, including when it comes to submitting your application to your mortgage lender, liaising with estate agents and keeping you updated.

Why you should consider a local mortgage broker like The Lending Channel

Local mortgage brokers take steps that bigger companies simple bypass. Read about the attractive measures taken by The Lending Channel mortgage team below.

We always get to know you

Most mortgage brokers claim to get to know and understand you and your needs. But can big high street lenders really put all their focus on the individual?

As a small, locally run, independent mortgage advisor, our clients truly lie at the heart of what we do. The Lending Channel has worked for many years to secure an enviable reputation as a highly knowledgable and highly personable team of experts. We understand that every one of our clients is unique, with their own individual circumstances. We aim to truly get to know you and deliver the bespoke service and impartial advice that serves you best.

While going to a more mainstream mortgage adviser, such as an online mortgage broker, is quick and convenient, it's impersonal and could overlook quirks in your situation that could impact the quality of the deal you're offered.

Access to lower wholesale rates through our connections

We've built fantastic relationships with our lenders over the years, allowing us to secure the wholesale rates that banks and retail lenders don't have access to.

As a small company, our team has got to know mortgage lenders on a personal level, meaning that it's more likely that we can negotiate the best deals for you.

Quicker closing times

As we are a dedicated small business, we have the resources to push your sale through to closing much faster than a large bank or retail lender does.

We understand that you want to get into your new home as soon as possible, and we work hard to make that happen.

We specialise in complex mortgages

The Lending Channel is a specialist mortgage broker , and we're expert advisors on the more nuanced and difficult mortgage types on the market. You might not find the same level of specialist knowledge from larger commercial lenders simply because many brokers are hired simply because they have a good general knowledge of the industry.

While our team has a well-rounded knowledge of the market, we also pride ourselves on our detailed knowledge of more specialist areas.

Contact us today

For some free mortgage advice, don't hesitate to contact our mortgage team today. We look forward to helping you!

.jpg)

.png)