If you or your business have outstanding invoices which are yet to be paid, they can be transferred to a third party for a fee; this is invoice financing.

The invoice financing company that agrees to buy your invoices, called an invoice financier, might be an independent specialist or could be part of your bank or another High Street financial institution.

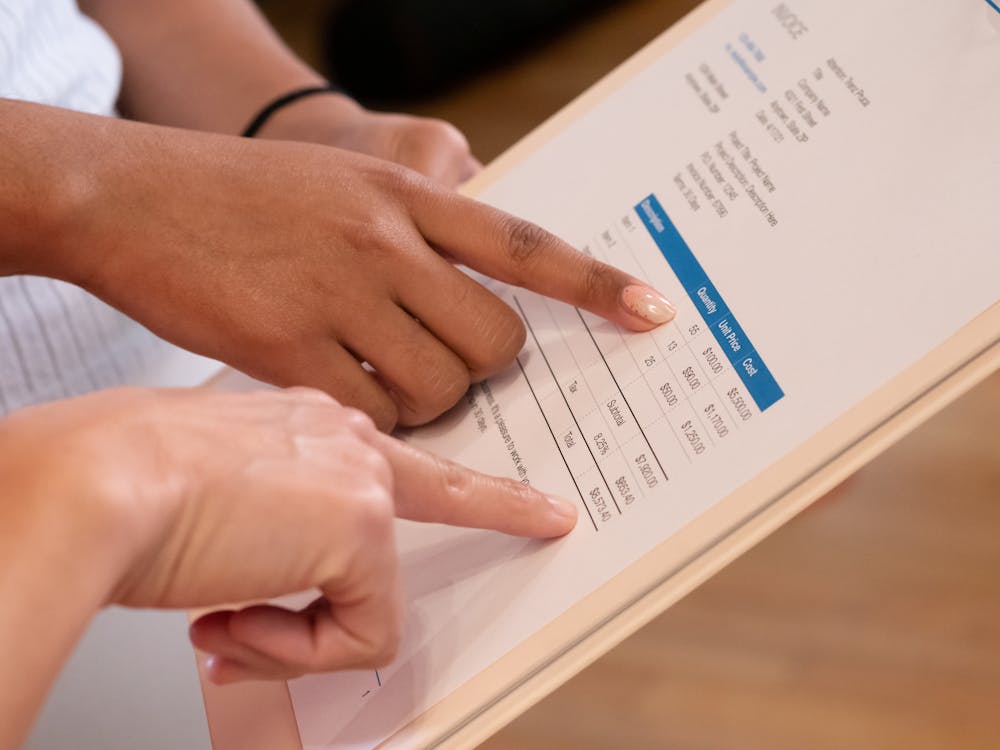

The typical process involves:

1. Get A QuoteGet a quote from the invoice financing facility. |

2. Send Your DetailsSend in the invoices for which you’d like funding. |

3. VerifyAll your details will be checked and verified. |

4. Get PaidOnce approved, you’ll have access to funds quickly and securely. |

Invoice finance can allow you to release the funds which are currently locked up in your outstanding customer invoices. Rather than waiting a month or more for invoice payments, you can receive up to 80% of an invoice’s value in as little as 24 hours.

Invoice financing offers you greater flexibility by providing faster access to capital, making it an excellent solution for small businesses. However, this option carries a cost, which can be comparatively expensive.

So, if you are being driven to consider this route by the need to access cash in the short-term, you should consider other finance solutions too, all of which can offer short-term funds when needed, such as:

In the UK, two basic types of funding available, factoring or invoice discounting.

This usually involves transferring your entire sales ledger to the invoice finance provider, who will pay you a percentage of the invoice value within 48 hours (usually around 85). They then take on the responsibility for collecting the unpaid customer payments.

Invoice trading uses an online platform to obtain finance from individual investors (or groups of investors) in a similar way to peer-to-peer lending. It means you don’t have to sell your entire sales ledger to a factoring company.

You get to pick and choose what invoices to sell (so there’s no need to outsource debt collection for the entire sales ledger). For example, if you have one customer that demands very different credit terms, you can choose to trade their invoices alone.